The Perspective for Companies

For entrepreneurs, our business model offers a strategic partner that goes beyond merely providing capital. We work closely with founders and top managers to identify and implement initiatives that accelerate business growth, improve operational efficiency, and increase long-term value. With a specific focus on small growth buyouts, we provide access to resources and expertise that are often not available through traditional financing. This approach allows us to co-create value in companies with less than €100 million in enterprise value, helping them achieve higher levels of scale and profitability.

The Perspective for Real Estate Sponsors

For real estate sponsors, our involvement goes beyond simple financing. We are actively engaged in the strategic management of projects, from acquisition through to completion. Our experience spans various real estate sectors, including residential, commercial, and tourism, with a focus on projects that offer a combination of stability and potential for appreciation. Our ability to identify and manage opportunities in established markets sets us apart as a trusted partner for institutional and private investors.

The Perspective for Investors

The independent sponsor model allows for greater transparency and a shorter investment horizon.

Continental Investment Partners’ Model

We offer a flexible, performance-oriented approach, where investments are made on a deal-by-deal basis. This allows us to select only the best opportunities, reducing risk and increasing return potential. Thanks to this flexibility, our investors can achieve a return on investment (ROI) that is typically 20-30% higher than traditional funds. Additionally, our model promotes greater alignment between the interests of General Partners (GPs) and Limited Partners (LPs), as GP compensation is strongly tied to the results achieved.

Traditional PE fund Model

Traditional closed-end funds, on the other hand, require an initial and committed capital investment for the entire duration of the fund, which can range from 7 to 10 years. While this model is historically well-established, it offers less flexibility for investors and may result in a more uncertain and diluted distribution of returns over time. Performance is often tied to the overall success of the fund rather than individual investments, which can lead to generally lower returns, with an annualized ROI that may be 15-25% lower compared to our model.

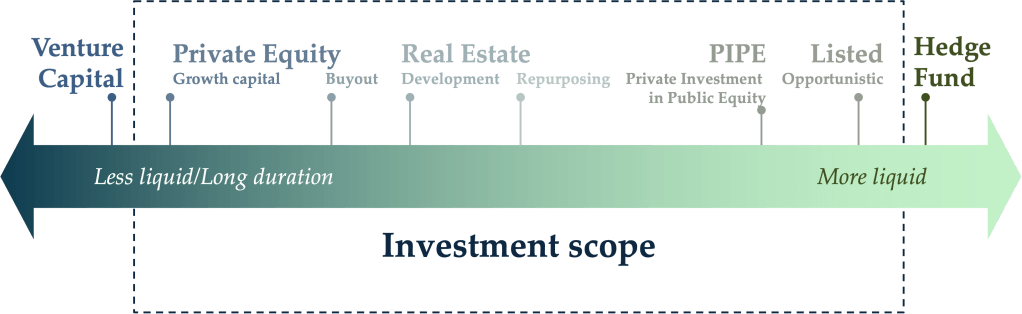

Investment scope

Our area of activity ranges from medium-term private equity operations (3-5 years) to real estate developments (2-3 years) and short-term tactical investments in publicly traded companies.

Thanks to the flexibility of our structure and the experience of our team, we are capable not only of structuring different types of operations but also of adapting and following the company’s equity story, transitioning from passive to active roles, from majority to minority stakes, and vice versa.

What we do

- Majority/Minority

- Management Buyouts

- Growth Capital

- Delisting and IPOs

- Active Investments in Public Companies

What we do not do

- Start-ups

- Bond/debt

- Funds/holdings

- Commodities

Who We Are

Carlo Sgarbi

Carlo is a recognized professional in investment banking and private equity, with over 30 years of experience in global markets. After holding numerous prominent positions within Global Markets, in 1999, he achieved the prestigious role of Head of Global Markets at Banca IMI, the investment bank of the Intesa Group, where he was responsible for managing approximately 300 professionals specializing in various risk areas (equity, fixed income, risk arbitrage).

Between 2007 and 2013, he was responsible for managing all investment activities within a major Swiss family office, where he met Marco a few years later.

In September 2013, he founded CIP, where he serves as Managing Partner, and is also a member of the Board of Directors of the wellness group Egosistema (ranked the best company in its sector in Italy for six consecutive years) and the hotel group Royal Antibes in France.

Marco Fumagalli

Marco has a significant track record of operations as a Global Partner at the private equity firm 3i Group, with notable results in managing investments in private companies (such as Giochi Preziosi, Coelsanus Preserves, Vis Pharmaceuticals, Newron) and publicly listed companies (Biosearch Italy, Datamat, Novuspharma) over 15 years.

In 2010, Marco met Carlo when he joined a Swiss family office. There, he was responsible for managing private equity activities until 2013, when he co-founded CIP with Carlo.

Managing Partner until 2016, Marco does not have anymore an operating role in CIP and currently serves as a Board Member of several companies including RanD and SourceBio International, as well as the Venture Capital fund P101 SGR; Marco is also member of the Strategic Committee of FinInt SGR.

Marcello Nesta

Marcello has over 10 years of experience in the financial sector, having started his career at SAI Investimenti SGR, the real estate investment fund company of the UnipolSai insurance group.

In 2011, he joined a corporate finance company in Switzerland, where he assisted small and medium-sized enterprises in raising debt and equity capital, as well as in M&A transactions.

Since 2017, Marcello has been an Investment Manager at CIP, actively involved in all of CIP’s investments, both as a Board Member and by overseeing the administrative and financial activities of the portfolio companies.

Valeria Giraldin

Active since 1990 in the industrial sector, Valeria has gained her experience in administrative/accounting roles at multinational companies, primarily in Italy, and from 2003 to 2013 she collaborated with a major Swiss family office.

Since October 2013, she has been the administrative manager and office manager at CIP.

Valentina De Paoli

Joining the team in March 2016, Valentina gained several years of experience in customer service, and in 2015 she held the role of office assistant for a trustee company in Lugano. She currently supports the administrative manager and provides assistance for the activities of the two partners.